kern county property tax search

File an Assessment Appeal. Change a Mailing Address.

Request a Value Review.

. If an employer requires information about you they will run a history check. A 10 penalty is added if the payment is not made as of 500 pm. Ad Look Here For Kern County Property Records - Results In Minutes.

Obtain a Recorded Document. Change a Mailing Address. Kern County CA property tax assessment.

Property Tax Rates Report. File an Exemption or Exclusion. If you are having trouble viewingcompleting the forms you will need to download.

File an Exemption or Exclusion. Search for Recorded Documents or Maps. Do not enter the street type city or ZIP code.

Handled by the Assessors Office Application to Reapply Erroneous Tax Payment. Cookies need to be enabled to alert you of status changes on this website. We do not endorse any of the vendors products or services nor do we guarantee the validity of information presented.

Change a Mailing Address. The Maps Recent Sales and Associated Data Are Provided Without Warranty of Any Kind either expressed or implied including but not limited to. File an Exemption or Exclusion.

Ad Find Anyones Kern Property Ownership. No CDs to load no concerns about dated information. The minimum combined 2020 sales tax rate for Kern County California is 725This is the total of state and county sales tax rates.

Search for Recorded Documents or Maps. Alta Sierra Arvin Bakers Air Park Bakersfield 1 Bakersfield 2. Find Property Assessment Data Maps.

Need Property Records For Properties In Kern County. The first installment is due on 1st November with a payment deadline on 10th December. Ad Search For Kern County Online Property Taxes Info From 2021.

Search for Recorded Documents or Maps. The County of Kern assumes no responsibility arising from use of this information. File an Assessment Appeal.

Additional info about MLS listings and legal issues. Click Advanced for more search options. Kern County Assessment Rolls httpassessorcokerncausprop_searchphp Search Kern County property assessments by tax roll parcel number property owner address and taxable value.

For approximately three weeks. Stay Connected with Kern County. Kern County Assessors Website httpassessorcokerncaus Visit the Kern County Assessors website for contact information office hours tax payments and bills parcel and GIS.

Property 2 days ago Payments can be made on this website or mailed to our payment processing center at PO. Website Usage Policy Auditor - Controller - County Clerk. Kern County Assessors Website httpassessorcokerncaus Visit the Kern County Assessors website for contact information office hours tax payments and bills parcel and GIS.

File an Exemption or Exclusion. Smith John or Smith. Find Property Assessment Data Maps.

Pay Transfer Tax on an Unrecorded. Purchase a Birth Death or Marriage Certificate. Information about foreclosure records in Kern County CA.

Request a Value Review. The Kern County Auditor-Controllers Property Tax section is currently in possession of Unclaimed Property Tax Refunds generally resulting from roll corrections or cancellations. Get In-Depth Property Reports Info You May Not Find On Other Sites.

Our online access to Kern County public records data is the most convenient way to look up Tax Assessor data property characteristics deeds permits fictitious business names and more. Request For Escape Assessment Installment Plan. Please enable cookies for this site.

Beginning Thursday June 30th 2022 at 500 PM. Kern County Treasurer and Tax Collector. Purchase a Birth Death or Marriage Certificate.

1115 Truxtun Avenue Bakersfield CA 93301-4639. The Kern County sales tax rate is 025. Kern County Assessment Rolls httpassessorcokerncausprop_searchphp Search Kern County property assessments by tax roll parcel number property owner address and taxable value.

The Kern County Treasurer-Tax Collector provides the following links for informational and reference purposes only. How to Use the Property Search. They might evaluate your profiles character as well as your past.

Jump to a detailed profile search site with google or try advanced search. The second installment is due on 1st. File an Assessment Appeal.

Box 541004 Los Angeles CA 90054-1004. Enter a partial or complete street name with or without a street number. To verify legal parcel status check with the appropriate city or county community development of planning division.

Search for Uncashed Property Tax Refund WarrantsChecks. Essex Ct Pizza Restaurants. Get Information on Supplemental Assessments.

Request a Value Review. Enter an 8 or 9 digit APN number with or without the dashes. Access vital information from any internet connection with one easy-to-use interface.

View Anyones Arrests Addresses Phone Numbers Aliases Hidden Records More. Secured tax bills are paid in two installments. Enter one or more search terms.

Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. Jump to a detailed profile search site with google or try advanced search. This unclaimed money consists of Property Tax refunds where a warrantcheck was issued that remains uncashed for a period.

800 AM - 500 PM Mon-Fri 661-868-3599. Search our listings of Kern County county property record locations to find what you need. Kern County Assessors Office 1115 Truxtun Avenue Bakersfield CA 93301 661-868-3485.

Sales tax rates are determined by exact street address. Purchase a Birth Death or Marriage Certificate. Get Information on Supplemental Assessments.

Please select your browser below to view instructions. Get Information on Supplemental Assessments. Enter only the street name and optional street number.

Application for Tax Relief for Military Personnel. Application for Tax Penalty Relief. Enter a 10 or 11 digit ATN number with or without the dashes.

Establecer un Plan de Pagos. The Online Payment System will be down for Fiscal Year End Processing. Ad Access to Market Value Estimates Deeds Mortgage Info Even More Property Records.

Connect from the office home road or around the world. The California state sales tax rate is currently 6.

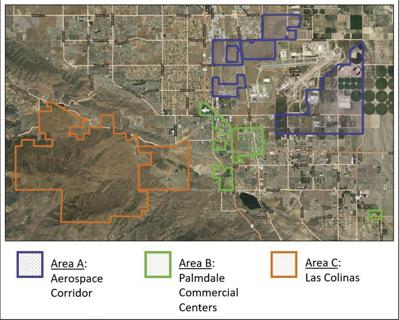

City Oks Infrastructure Boosting Plan Local News Avpress Com

Kern County Awarded U S Department Of Energy Communities Leap Technical Assistance Grant For Development Of Clean Energy Carbon Management Business Park County News Kern County Ca

California Sales Tax Guide For Businesses

Prop 15 Taxes On Commercial Property California General Election Ballot Measures Voter Guide Tuesday November 3 2020 Voter S Edge California Voter Guide

Assessor Recorder Candidate Accusing Other Candidate Of Not Filing Campaign Finances Kbak

![]()

Palmer Kern Palmer Kern The Property Valuation Specialists

California Retirement Tax Friendliness Smartasset

California Public Records Public Records California Public

California Sales Tax Guide For Businesses

![]()

Palmer Kern Palmer Kern The Property Valuation Specialists

California Retirement Tax Friendliness Smartasset

New York Property Taxes By County 2022

Braden Murphy Launches Potentially Historic Campaign For Calif Board Of Equalization

San Benito County Ca Property Tax Search And Records Propertyshark